The smart grid, battery storage and energy-efficiency sectors collectively raised only $102 million in venture capital (VC) funding during the third quarter of this year (Q3’16) – down from the $433 million raised in the previous quarter, according to a new report from Mercom Capital Group. Nonetheless, the report does offer some positive news: Battery storage residential and commercial project funds hit a record high during Q3’16.

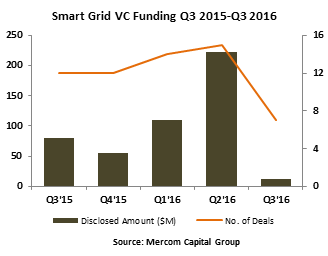

The report says VC funding, which includes private equity and corporate venture capital, for smart grid companies came to $11 million in seven deals in Q3’16, the lowest amount of VC funding for a quarter since Mercom began tracking funding activity. In Q2’16, $222 million went into 15 deals. In a year-over-year (YOY) comparison, $81 million went into 12 deals in Q3’15. Furthermore, the report says there were seven VC investors that participated in smart grid deals in Q3’16, compared to 46 in Q2’16.

VC funding for battery storage companies declined sharply in Q3’16, reaching $30 million in nine deals compared to $125 million in 10 deals in Q2’16 as significant funding activity shifted to battery storage project funds in the third quarter. YOY funding in Q3’16 was lower than in Q3’15, which had $96 million in nine deals.

The report notes that VC funding was spread across six battery storage sub-technologies: supercapacitor, lithium-based batteries, energy storage management software, energy storage systems, thermal energy storage and flow batteries.

Announced debt and public market financing for battery storage technologies totaled $51.6 million in three deals in Q3’16, compared to $40 million in one deal in Q2’16. FuelCell Energy raised $40 million through the sale of shares and warrants, Electrovaya secured a loan of $10 million, and Ixous raised $1.6 million in debt funding.

Despite the drop in VC funding activity, the report says it was a record quarter for battery storage residential and commercial project funds, which totaled $625 million in four deals, compared to $175 million raised in two deals in Q2’16. Tabuchi America raised $300 million in project financing for residential solar-plus-storage installations in the residential sector’s only project fund. On the commercial side, Advanced Microgrid Solutions secured $200 million in funding from Macquarie Capital. Stem, a provider of commercial behind-the-meter energy storage systems, announced an investment of up to $100 million from Starwood Energy Group. Sharp’s Energy Systems and Services Group, a division of Sharp Electronics Corp. (the U.S. subsidiary of Osaka-based Sharp Corp.) and a developer of a behind-the-meter energy storage system for peak demand reduction for commercial and industrial building owners, announced $25 million in funding for solar coupled with its SmartStorage energy storage solution.

Since 2013, the report says, $1.1 billion has been raised in battery storage project funds.

In Q3’16, the report says VC funding for energy efficiency technology companies fell again, with $61 million in five deals compared to $86 million in nine deals in Q2’16. In a YOY comparison, VC funding for efficiency companies in Q3’15 was much higher, with $316 million in 17 deals.

More information about the report is available here.